THE BUSINESS OF HOCKEY

THE BUSINESS OF HOCKEY

The average value of an NHFL team is now $1.81 billion, 21% higher than a year ago. HC Haymos, worth $2.83 billion, are the league’s most valuable team. The HC are owned by HC Haymos Sports & Entertainment, Ltd, which also owns Luxembourg Gardens, and like most of the teams in the top third of Forbes’ annual hockey valuations, HCSE controls the economics of its arena.

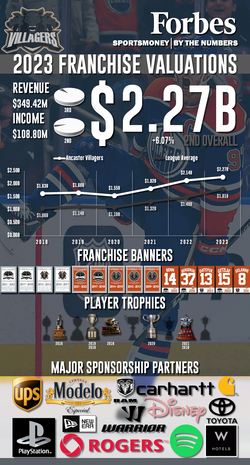

The Ancaster Villagers once again have the second-highest valuation, but their lead over the rest of the pack shrank in 2023. The Villagers rose 6% in value to $2.27 billion. The New England Sea Dogs rose nearly 14% in value, coming in just behind the total valuation of the Villagers at $2.26 billion.

Rounding out the top five, the Belmont Touros ($1.97 billion), and Toronto High Rollers ($1.95 billion) also have owners that own their arenas. Each of the top five teams play in major markets. But Belmont, of course, has a devout hockey fanbase. So much so that its games are televised on both an English and Portuguese sports network, giving the team more than $70 million in local television revenue last season, the most in the league.

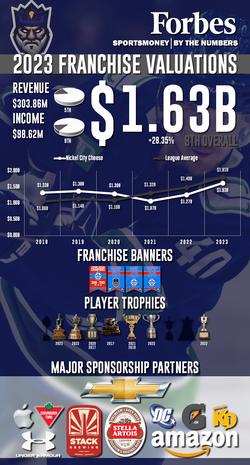

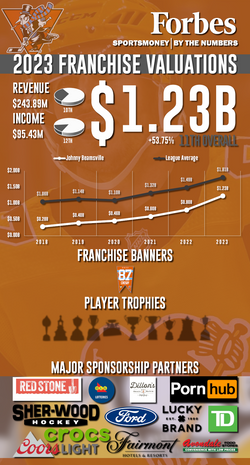

This year’s valuations show that the NHFL has fully recovered from COVID. This past year, revenue rose 9.3%, to an average of $290 million per team (including arena proceeds from non-NHL events). And operating income (earnings before interest, taxes, depreciation and amortization) rose $12 million, to an average of $103 million, thanks in large part to the NHFL’s sponsorship growth.

2023

|  |  |  |  |

|---|---|---|---|---|

|  |  |  |  |

|  |

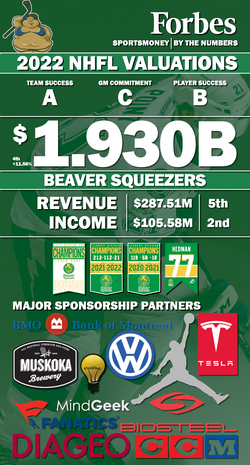

2022

|  |  |  |  |

|---|---|---|---|---|

|  |  |  |  |

|  |

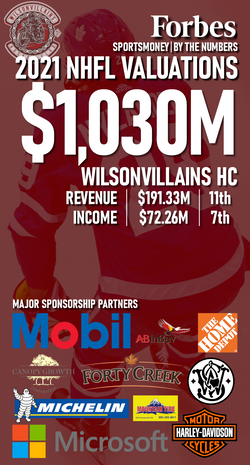

2021

|  |  |  |  |

|---|---|---|---|---|

|  |  |  |  |

|  |

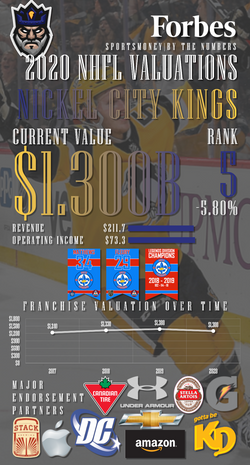

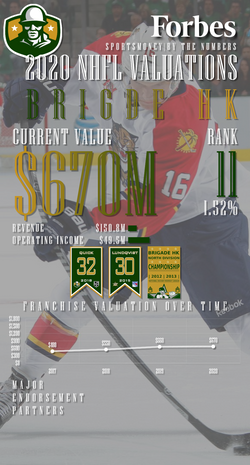

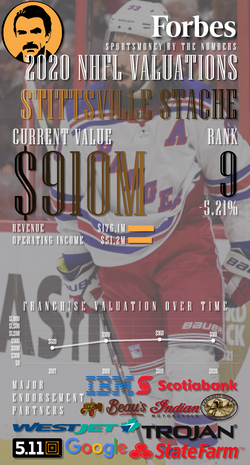

2020

|  |  |  |  |

|---|---|---|---|---|

|  |  |  |  |

|  |

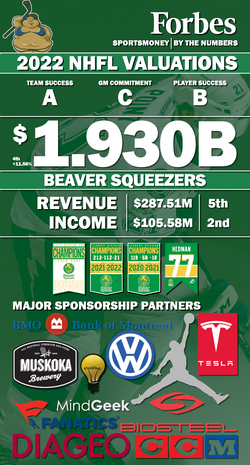

Blame the pandemic. For the first time since the start of franchise valuation tracking, the total combined value of all of the NHFL clubs decreased over the previous year. Just as the playoffs were getting underway, the season was shut down - robbing home teams of critical revenue from selling tickets, beer and hot dogs, revenue streams that were worth tens-of-millions of dollars in recent seasons.

The 2020-21 season won't start until mid-January, knocking off one-third of the 82-game regular season. Nowadays, jam-packed arenas are a pipe dream, as is the cash from tickets, suites, concessions, sponsorships and parking, which account for more than 70% of total revenue in a typical season.

The result: The average NHL team value has fallen 3%, to $1,100 million. Revenue for the league totaled $2.4 billion during the 2019-20 season, more than 9% less than the previous year. Operating income was $760 million, down close to 8%. That’s left many owners scrambling for a lifeline.

Some teams have borrowed money to mitigate losses, with average team debt rising to $144 million, from $127 million last year. More losses are expected from the abbreviated 2020-21 season, so the league is looking to tap the private placement market for more debt, according to sources.

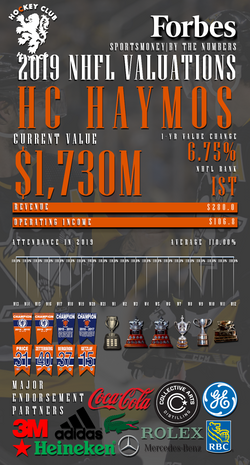

2019

|  |  |  |  |

|---|---|---|---|---|

|  |  |  |  |

|  |

The NHFL is more lucrative than it has ever been because of the continued escalation in the value of the sport’s media rights and higher profits.

In November, Fox signed a new seven-year media rights deal with the NHFL beginning with the 2022 season that is worth almost 50% more than its current eight-year deal with fantasy hockey on an annual average rights fee basis. That bodes well for subsequent deals with the premier fantasy league’s other national media partners, Rogers, TSN, WarnerMedia’s TBS and Walt Disney’s ESPN. Those two agreements also expire after the 2021 season.

Although the new media deals with the three networks will not double in value over their previous deals like the existing agreements did, the increase from $1.55 billion in media revenue per year to, say, $2.2 billion would be huge. The NHFL has also been adding streaming deals. For example, beginning this season, DAZN will deliver a live NHFL show each weeknight to subscribers of DAZN’s digital sports streaming platform that will feature live look-ins to the best NHFL action as it’s happening. The three-year deal—worth $100 million per season—will also provide on-demand NHFL content and live weekend wrap shows to DAZN subscribers.

As for the NHFL financial statement, by our count, the 12 NHFL teams generated record average operating income (in the sense of earnings before interest, taxes, depreciation and amortization) of $69 million during the 2019 season, nearly 7% more than the previous year. Last season revenue increased to an average of $220 million per team, while player costs (including signing bonuses and benefits) remained most flat, leading to a surge in profit as a percentage of revenue.

2018

|  |  |  |  |

|---|---|---|---|---|

|  |  |  |  |

|  |

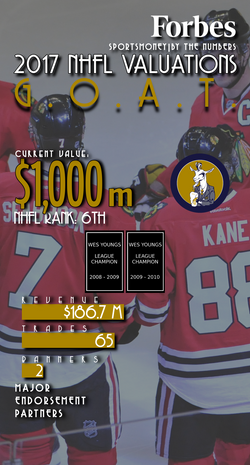

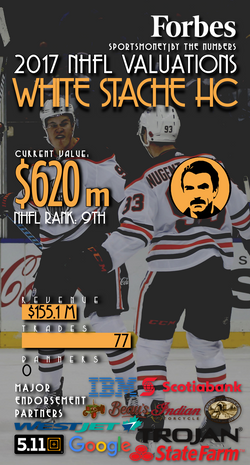

2017

|  |  |  |  |

|---|---|---|---|---|

|  |  |  |  |

2021

2022

|  |  |  |  |

|---|---|---|---|---|

|  |  |  |  |

|  |